Limited Liability Partnership (LLP) is a newly introduced corporate entity type in India aimed at small and medium-sized businesses. An LLP provides many of the benefits of a Private Limited Company while being easier to maintain compliance. Low registration fee and easy maintenance make LLP a first choice for many of the small businesses in India. In this article, we look at the LLP registration procedure and the documents required.

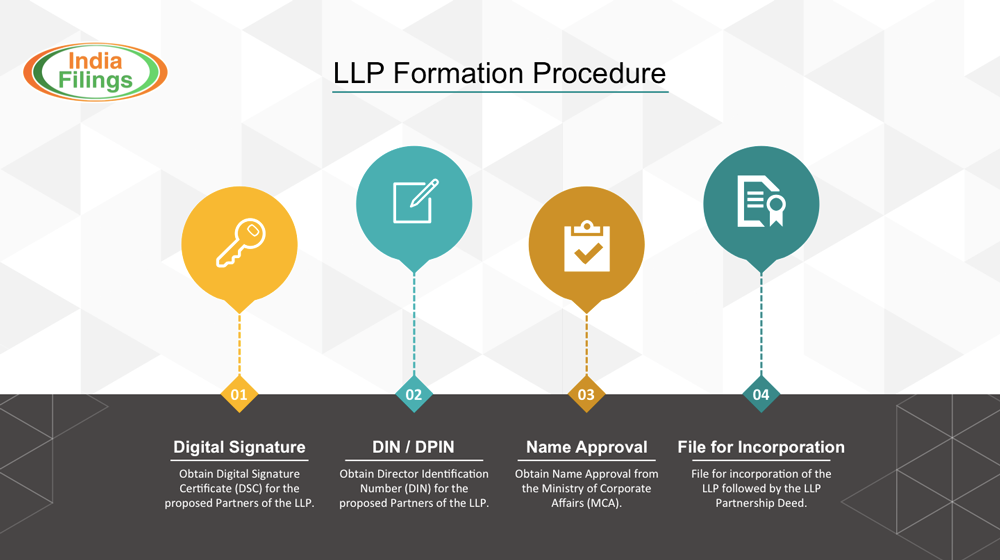

LLP Formation Procedure

The procedure for the formation of an LLP is very similar to that of a Private Limited Company incorporation procedure. A minimum of two Partners are required to start the LLP formation procedure and a registered office location is required within India. It is important to remember that FDI in LLP is allowed only with the prior approval of the Reserve Bank of India (RBI). Therefore, it is recommended that NRI’s and Foreign National promoters opt to incorporate a Private Limited Company, where 100% FDI is allowed under the automatic route.

LLP Formation Documents Required

To register an LLP in India, the following documents are required:

- PAN Card of the Partners

- Address Proof of the Partners

- Utility Bill of the proposed Registered Office of the LLP

- No-Objection Certificate from the Landlord

- Rental Agreement Copy between the LLP and the Landlord

The PAN Card of the Partners and the Address Proof the Partners are required to start the LLP formation procedure. The documents pertaining to the Registered Office of the LLP can be submitted after obtaining name approval for the LLP from the Registrar of Companies.

Step #1: Obtain Digital Signature Certificate (DSC) for the Partners

For obtaining DIN (Director Identification Number or Designated Partner Identification Number) for the Partners of the LLP, a Digital Signature Certificate (DSC) is required. Therefore, the proposed Partner must obtain a Digital Signature Certificate. A person can obtain the DSC within one day of filing of the DSC Application with IndiaFilings. Digital Signatures usually have a validity of one or two years and can be used during that time for filing of Income Tax documents online or Ministry of Corporate Affairs (MCA) documents online.

Step #2: Obtaining Director Identification Number for the Partners

Once, Digital Signatures are obtained for the Partners, application for Director Identification Number (DIN) can be made. DIN registration usually happens immediately and in rare cases, additional documents must be submitted to the DIN Cell for approval of the DIN application. DIN and DPIN are synonymous and can be used interchangeably. Further, once a DIN is obtained, there are no renewals required and each person can have only one DIN.

Step #3: Obtaining Name Approval

Once two DIN’s are available, application for reservation of name can be made to the MCA. It is important for the promoters to keep in mind the LLP Naming Guidelines and suggest appropriate names for the LLP in the application, to ensure speedy approval. Upon the submission of application for reservation of name to the MCA, Registrar of Companies (ROC) in the State of Incorporation will process the application. The processing time for name approval application differs from ROC to ROC based on the workload.

Step #4: Filing for Incorporation

After the acceptance of the name approval application by the MCA, an LLP name approval letter will be issued to the proposed Partners will get the approval letter. The Partners then have 60 days to file the required incorporation documents and register the LLP. In case of not filing the LLP within 60 days of the name approval letter, a person must re-obtain the approval for a name for the LLP.

While filing for the formation of LLP, the documents showing possession of the registered office would be required. Once prepared, the registered office related documents along with the signed subscribers’ sheet must be filed with the MCA for registration of the LLP.

If the application for LLP Registration is acceptable, the Registrar would issue the incorporation certificate. Once, the incorporation certificate is issued, the LLP will be considered to be registered and application for PAN for the LLP can be made. The Partners of the LLP then have 30 days time to file the Partnership Deed of the LLP with the MCA. In case of not filing the LLP Partnership Deed within 30 days, a fine will be applicable.

Comments

Post a Comment